Today we have the pleasure of sitting down with Mike Taormina, Co-Lead of Institutional Business at...

Passive Income in DeFi - A Traditional Investor’s Guide to Earning Yield in Crypto

Originally posted on the Index Coop blog

Earning yield on crypto is decentralized finance’s (defi) answer to interest earnings on savings accounts or fixed investment vehicles. While both defi and traditional finance (tradfi) offer passive income opportunities, defi yield rates can offer far greater returns than are available using tradfi interest rates.

In this article, Index Coop and HeightZero review the basics of earning yield on cryptocurrencies then move to specific ways to earn yield. We’ll also detail a number of considerations specifically for traditional investors who are interested in earning yield on their cryptocurrency.

Basics of Earning Yield

Earning yield in crypto is the practice of using defi to generate returns on cryptocurrency in the form of additional cryptocurrency. Defi users earn variable yield by depositing cryptocurrency into a staking pool, lending protocol, or liquidity pool and gain fees on its use while it is locked up for a period of time. Investors can also invest in fixed yield products and strategies that offer a more predictable return.

This process involves using instruments of decentralized finance (defi) to generate returns on digital assets. Smart contracts, programs of code stored on the blockchain, automatically executes complex transactions when predetermined conditions are met, without the need for a financial intermediary like a bank.

Expected yield returns are usually annualized. The two most commonly used measures are annual percentage rate (APR) and annual percentage yield (APY). The difference is that APY accounts for compounding interest, interest accrued on both the principal and the accumulated interest from previous periods, but APR only calculates interest on the principal.

Yield on cryptocurrencies and other digital assets is often higher than tradfi rates.

Ways to Earn Yield

There are many different ways to earn yield on cryptocurrencies and other digital assets. Investors can use activate strategies to earn variable yield through staking, lending, and liquidity providing or fixed yield using protocol strategies. More passive yield-earning strategies are available through products like Index Coop’s icETH or asset managers’ vaults.

Below, we’ll review these three ways to earn yield.

Variable Yield

Variable yield can be earned through staking, lending, and providing liquidity. APRs can be significantly higher than interest rates on savings accounts in traditional finance.

There are three major variable yield-earning strategies:

-

-

Staking: Staking is the process by which network participants agree to set aside a certain amount of cryptocurrency, usually in a “staking pool,” to become an active validating node for a blockchain network. They earn rewards for investing in equity to backstop a cryptocurrency via staking, just like how investors earn dividends on stocks. The most decentralized option is Lido, which lets investors stake assets from several networks, like Ethereum, Solana, and Polygon. Centralized exchanges like Coinbase and Crypto.com offer staking pools in house.

-

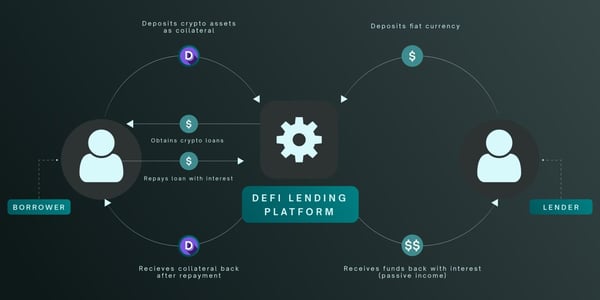

Lending: Lending allows investors to deposit money to lending platforms that loan it out in exchange for collateral plus interest by borrowers. Lending platforms reward lenders with yield on their lent cryptocurrency captured from interest paid on loans by borrowers, much like how banks pay interest savings accounts for the privilege of lending out the money it contains. Popular decentralized lending platforms include Aave, Compound, and Maker. More centralized lending platforms are Crypto.com, blockFi, and Nexo.

-

-

Providing liquidity (LPing): Liquidity providers (LPers) deposit cryptocurrency into liquidity pools available on “automated market makers” (AMMs), defi’s version of tradfi’s market makers. AMMs are “automated” in that they allow assets to be traded automatically by using liquidity pools instead of relying on willing buyers and sellers. These AMMs charge a fee every time someone trades one of the token pairs in a respective liquidity pool. A portion of those fees is then distributed to the LPers, based on the amount they deposited into the pool. Some popular AMMs are Uniswap, Curve, and PancakeSwap.

Importantly, while variable yield often offers higher returns compared to less-risky fixed yield, successful investors must constantly monitor rates and adjust investment strategies according to the best yield opportunities, which can shift at any time.

Fixed Yield

Earning fixed yield is another option for investors looking to earn passive income. Fixed yield strategies are much more conducive to long-term growth; interest rate does not change for the course of the maturity period. Benefits of fixed yield include:

-

Predictability: Yield rate remains the same throughout the maturity period, impervious to the volatile crypto market. For accounting and tax purposes, investors can easily predict whether a certain fixed yield product will meet their minimum profit margins.

-

Safety: Reinvestment Risk is removed as fixed rate yield opportunities do not provide interest payments throughout their maturity periods or terms.

-

Simplicity: For investors uninterested in frequently adjusting strategies to ascertain the best returns, fixed yield products simplify strategy. Fixed yield products offer true passive income; since rates do not change for the entirety of a maturity period, investors do not need to actively manage their funds.

Right now, there are few options to earn fixed yield:

-

Element Finance is a protocol for fixed and variable yield markets. It allows users to split a yield-generating position’s underlying asset (e.g. ETH) into a principal token and a yield token that trade at a discount and offer a fixed yield rate if the token is held until its redemption date.

-

Notional Finance is a borrowing and lending protocol that created its own fixed rate money market. Lenders can lock in fixed yield for up to one year, with the yield coming directly from what borrowers pay to lock in their borrowing rates. The underpinning mechanism, fCash tokens, function similar to a zero-coupon bond, as the tokens trade at a discount before maturity. Users can exit the position early by closing out the remainder of the term at the current market rate.

Yield Products

Investors looking to maximize yield may be interested in yield products, like leveraged yield products and asset managers’ vaults, which expand upon typical ways of earning for investors looking for passive yield accrual. These products tend to be higher-risk and higher-return than both variable and fixed income strategies due to the involvement of more yield earning strategies and variables that affect each.

Deciding between yield strategies requires time, knowledge, and often active management of the chosen position. Yield products extract the guesswork out of selecting a specific protocol by instead offering exposure to a predetermined automated strategy. These automatically managed strategies can provide investors with passive income:

-

Index Coop’s Interest Compounding ETH Index (icETH): A leveraged yield product, icETH provides investors with amplified exposure to staking yield on ETH via a continuous cycle of borrowing ETH for stETH and swapping for more stETH.

-

Index Coop’s Market Neutral Yield on ETH (MNYe): MNYe holds a permanent short ETH perpetual position and spot ETH in an equivalent amount, allowing investors to capture yield from the funding rate in the ETH perpetual market while holding a market neutral position.

-

Vaults of Asset Managers: Asset managers like yearn.finance, Balancer, and Rari allow investors to deposit a range of tokens which are pooled into “vaults” and automatically allocated to optimize returns. In this way, the vaults act like hedge funds, using pooled funds to earn active returns for investors. For example, several vaults act as liquidity pools and distribute yield among vault contributors proportional to the size of their contribution.

-

$FIXED Yield Tokens from Index Coop: The latest product from IC (launching July 2022) is an ERC-20 index token that utilizes yield from Notional’s DAI pools, functioning in essence like defi’s first bond ETF. Creating an index token means users will no longer have to interact with the Notional protocol directly.

Considerations for Traditional Investors

While yield strategies in crypto follow similar patterns of interest-earning on stocks and bonds, traditional investors should consider the unique risks of yield earning strategies and understand basic requirements of participation in defi before investing in yield opportunities.

Risks

By removing middlemen, defi eliminates the risks posed by human error—purposeful or not—present in tradfi transactions. Accurate smart contracts ensure that financial transactions are not manipulated by humans making money laundering and miscalculations impossible.

Following the risk-reward tradeoff, earning yield in crypto is a riskier activity than earning passive income in the form of interest in traditional finance. With financial middlemen replaced by programmable smart contracts and blockchain infrastructure, yield products, and defi generally, present risks that cannot be mitigated by the reputation of intermediaries. These have no equivalent in traditional capital markets and are not dealt with in traditional risk management framework.

Systematic Risks impact the entire defi ecosystem, affecting all crypto products, yield-earning or not. These include:

-

Currency Risk: In defi, liquidations are fixed in smart contracts behind crypto products, meaning they occur automatically when triggered by black swan events. While tradfi investments face currency risk as well, investments in defi may be more vulnerable due to the volatile crypto market.

-

Regulatory Risk: Defi is a new and largely unregulated space. However, many governments are considering enacting regulations that could impact investors in a wide variety of unforeseeable ways. In the United States, the major question around cryptocurrency regulation concerns the Security Exchange Commission’s (SEC) pending decision on whether cryptocurrencies and crypto products are commodities or securities. If the SEC categorizes cryptocurrencies as securities, they will face greater regulatory scrutiny.

-

Blockchain Risk: Defi employs blockchain technology; investments in defi, thereby, face security risks according to the blockchain they are built on. A chain’s age, adoption, user activity, and level of decentralization are the most important considerations. Thus, investments on the Ethereum (ETH) chain are less vulnerable to Blockchain Risk than investments in a less-established chain like Solana (SOL).

Furthermore, yield earning products specifically face idiosyncratic risks, those that impact specific protocols or assets. These include:

-

Smart Contract Risk: If not built correctly, the foundation of yield strategies and products, smart contracts, may be compromised and thus so will the strategies built on them. The putative quality and security of the code underpinning an asset, protocol, product, or service in defi is important, similar to the reputation of a bank in tradfi. It can be compared to Counterparty Risk present in tradfi.

-

Oracle Risk: Oracles, data feeds that protocols and assets rely on, can be compromised along with the products built on them. For yield products, Oracle Risk lies largely with those built on centralized oracles, those controlled by a single entity that acts as the sole data provider for a smart contract.

-

Liquidity Risk: Investors’ ability to enter or exit a position freely without excessive slippage, the price difference between a cryptocurrency’s quoted price and paid cost, may affect the purchase and sale of yield products.

Protecting Your Crypto

Yield opportunities in defi occur directly on the blockchain, meaning they come with some stipulations that may be unfamiliar to traditional investors. In order to transact on the blockchain, an investor will need a digital wallet. The wallet contains a private key that is used to authorize the transfer of a cryptocurrency to either another wallet or a smart contract. If an investor loses access to their wallet - i.e. they forget their password, they will then in turn lose their private keys and won’t be able to access the cryptocurrencies held within that wallet. Also if someone were to gain control of a wallet and the keys - i.e. through a spam, phishing or spoofing attack, they could transfer all of the assets out to another wallet. Due to the immutability of blockchains, there is no way to undo or reverse a transaction so when cryptocurrencies are stolen from a wallet, there unfortunately is no recourse to reclaim the assets. For that reason, some investors will leverage a qualified custodian to store their wallet keys.

Custodians

Qualified custodians such as Coinbase, Gemini and BitGo leverage robust security measures to ensure the protection of the wallet keys and maintain access to the assets. They can also alleviate certain compliance issues when an investor is working with a financial advisor or wealth manager. If an asset manager has access or is privy to their clients’ keys, they may be deemed a custodian of the assets in the wallet and subject to various disclosures and reporting reporting requirements. Keeping the keys stored with a qualified custodian can avoid that type of scenario.

While outsourcing the safekeeping of wallet keys to a reputable, qualified custodian can make it easier to invest in crypto, some may view it as a less secure solution. The added layer of a centralized, third party introduces new areas of vulnerability and the investor must conform to the procedures of the custodian. An alternative is to use what is known as a “non-custodial” wallet. A non-custodial wallet is one in which the investor is solely responsible for securing their private keys. These wallets can be web based (either through a browser or mobile device), or come in the form of what is known as a “hard wallet”. Hard wallets are physical devices like a jump drive, that can store encrypted private keys off-line - i.e. without being connected to the internet, a process known as “cold storage”. This approach is generally regarded as one of the most secure ways to protect a wallet’s private keys. However it requires additional effort to maintain the wallets and generally a higher level of technical expertise than an average investor may possess, or want to possess. Examples of online non-custodial wallets are MetaMask, Coinbase Wallet and TrustWallet. Ledger and Trezor are two or the most common hardware (offline) wallets.

Non-custodial Wallets

To participate in yield opportunities on the blockchain, an investor will generally need to use a non-custodial wallet. Qualified custodial wallets typically lack the capability to plug directly into these defi protocols due to the centralized nature in which the private keys and their associated cryptocurrencies are secured. However some providers, such as Coinbase, are working on solutions to bridge that gap in upcoming product releases and others such as BitGo, already have some lending and staking capabilities in place. As discussed above, financial advisors and wealth managers will often leverage qualified custodians to secure their clients’ private keys and avoid the need to custody those assets themselves, thus aligning with regulatory best practices. The drawback to this model is that investors may then be limited in the defi yield opportunities that they can pursue. These are factors that an asset manager should take into consideration when assessing the appropriate custody model and providers for their clients.

Associated Fees

Another factor to be aware of for investors looking to take advantage of defi yield opportunities is on-chain processing costs. Transacting on the blockchain incurs fees known as “gas”. The price of gas will vary depending on the particular blockchain as well as the current trading activity. Higher volumes will result in greater demand for transaction validations which in turn results in more expensive gas fees. Likewise, low trading volumes will yield cheaper gas fees. The fluctuations in gas prices can result in unexpectedly high transaction costs that may offset some of the substantial gains earned from the yield. This can be particularly evident with variable yield opportunities where an investor may be constantly swapping in and out of various protocols in search of the best rates available at any given time. On the other hand fixed rate and yield products may offer a better alternative to variable rate strategies for investors concerned with gas fees as these options tend to be more of a buy and hold approach, locking in gains over a longer period of time with minimal transacting required.

Tax Implications

One final area of consideration when pursuing yield opportunities is the tax implications of the various transactions. Depending on the investor’s tax locale, these activities may generate taxable events which can reduce the net value earned and negatively impact their overall financial plan. This is another example where strategies that require less transacting such as fixed rate and yield products may be a more attractive option when investing in jurisdictions with a high tax rate.

When it comes to yield generation in defi an investor has many factors to consider. While no one solution may be a perfect fit, understanding the advantages and risks of the different strategies available will help ensure the greatest opportunity for effective wealth creation over time.

For enquiries regarding yield opportunities in Index Coop products, please reach out to institutions@indexcoop.com.

Index Coop is a decentralized autonomous organization (DAO) that creates decentralized financial products that unlock prosperity for everyone. We build simple yet powerful index products to provide access to a variety of crypto investment themes and make it simple, safe and affordable to invest in decentralized finance.

HeightZero is a Turn-Key Digital Asset Management Platform (TDAMP) created for advisors, by advisors. As a technology offering that aims to simplify access to crypto for wealth managers, HeightZero has partnered with an extensive network of financial, legal and digital service providers to deliver best in class solutions for their customers.

Disclaimer: This content is for informational purposes only and should not be construed as legal, tax, investment, financial, or other advice.